Arc Acquires Touchpoint Markets

Arc Acquires Touchpoint Markets; Strengthening Presence in Financial Services and Human Resources

LONDON, 1 July 2025 – Arc, the global events, data, and marketing services platform, today announced its acquisition of Touchpoint Markets, a U.S.-based marketing and events provider, strengthening Arc’s U.S. presence and depth in key market sectors.

The acquisition brings a powerhouse portfolio of leading brands across human resources, finance, insurance, and real estate to the Arc network, including ThinkAdvisor, BenefitsPRO, PropertyCasualty360, GlobeSt, and Credit Union Times. These brands are deeply embedded in the communities they serve, and by joining Arc, they will gain even more reach, resources, and momentum.

Simon Foster, Group CEO of Arc, said, “This acquisition marks a key step in Arc’s growth. By combining Touchpoint Markets’ premier brands and experienced team, we are expanding our capabilities and market reach in the U.S. I look forward to our teams collaborating to unlock the full potential of both the Arc U.S. and Touchpoint brands.”

Matt Weiner, President & CEO of Touchpoint Markets, added, “We’re excited to join forces with Arc. We share a deep commitment to our brands and the professionals we serve. This partnership strengthens our ability to grow engaged communities with meaningful content, actionable insights, and high-value experiences. With Arc’s leadership in events and commitment to innovation, there is significant potential ahead.”

Together, Arc and Touchpoint Markets will accelerate growth across both companies, delivering stronger event experiences, enhanced data and subscription products, and more opportunities to connect professionals with the insights, tools, and networks they need to thrive.

Tim Hart, U.S. President of Arc, added, “We’re thrilled to welcome the Touchpoint team to Arc’s U.S. business. Their expertise will be instrumental as we pursue bold growth plans across the market – including event launches in human resources, education, and agriculture, as well as new data and subscription products. Touchpoint’s deep experience in marketing services and community engagement will accelerate our momentum, helping us scale faster and smarter. We’re also eager to build on the strong foundation of Touchpoint’s events business — including BenefitsPRO BROKER EXPO, where we see powerful synergies with our flagship HR Tech brand.”

This move represents the ninth acquisition Arc has made since 2021 as it continues to put together a network of leading businesses in dynamic and growing end markets. As part of the integration, the Touchpoint Markets brand will be retired, with its portfolio of trusted brands seamlessly integrated into Arc.

Jones Day and Alvarez & Marsal served as Arc’s legal advisor and accounting advisor, respectively. JEGI CLARITY represented Touchpoint Markets in this transaction.

End

About Arc

Arc is a B2B events, data, and marketing services platform, backed by investment funds managed by EagleTree Capital. Founded to redefine business networking, Arc organises over 150 events a year and operates critical content platforms in HR, agriculture and food, financial services and investing and education technology. Arc has over 350 talented colleagues located in the US, UK, Netherlands, and Singapore who focus on seeking out new ways to connect communities, wherever, whenever, or however people need to come together to grow their businesses.

For more information, visit arc-network.com or find Arc on LinkedIn.

About Touchpoint Markets

Touchpoint Markets is a trusted source of intelligence, connection, and opportunity for today’s leading professional communities. We are committed to engaging and supporting professionals across key industries—including Wealth Management, Insurance, Commercial Real Estate, Credit Unions, Consulting, and Corporate Treasury. Our ecosystem is built on expert journalism, immersive experiences, and innovative digital platforms that deliver essential insights and drive real engagement. We connect industry decision-makers with the information, solutions, and relationships they need to lead in a rapidly evolving marketplace.

To learn more, visit TouchpointMarkets.com.

Contacts

Caitlin Read [email protected]

Amy Sievertsen [email protected]

Incisive Media wins Awards Event of the Year at the 2024 Conference and Events Awards

Incisive’s Media has won gold in the prestigious Awards Event of the Year category at the 2024 Conference and Events Awards.

Incisive took the honours with its Women in Insurance Awards event, seeing off stiff competition from the likes of Haymarket and Dezeen.

The 2024 Conference and Events Awards took place on Friday, July 5 at the Honourable Artillery Company in the City of London. It is recognised as the premier event for the conference and events sector and was hosted by Rory Bremner and Ellie Taylor.

Incisive’s Women in Insurance Awards is part of the media owner’s suite of diversity events that include Women in Investment and Women in Financial Advice. Women in Insurance is produced by in-house events agency Incisive Connect.

Incisive was cited for its “steadfast commitment to diversity in the financial services sector, combined with a high-quality event that really celebrated women’s contribution to insurance”.

“I am delighted that our teams have received such richly-deserved recognition for their dedication,” said Incisive Media’s chief marketing officer Sophie Eke. “It’s a powerful endorsement of the hard work and innovation that takes place across our business to deliver outstanding and meaningful events for our audiences.”

The win continues a strong run for Incisive at these awards: in 2023 the media owner won the best new conference (up to 700 attendees) category for the Investment Week Leaders Summit, a new launch from the publisher’s flagship brand, plus a bronze award in the best events team category for its event operations team.

Incisive Media is owned by Arc network, the fast-growing B2B media and events business with global operations across the financial, agriculture, food, sustainability sectors.

The 2024 Women in Insurance Awards takes place on October 17 at the Park Plaza Westminster Bridge, London, click here for more information.

Arc expands agriculture sector offerings with acquisition of Low Carbon Agriculture

Arc, the global events, data, and media company backed by investment funds managed by EagleTree Capital, announced today it has acquired Renewable Energy Events Ltd., a portfolio of events and media assets serving the sustainable farming sector, which includes Low Carbon Agriculture (LCA).

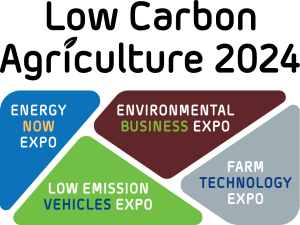

LCA is comprised of four co-located events, Energy Now Expo, Environmental Business Expo, Farm Technology Expo, and Low Emissions Vehicle Expo. These content-led exhibitions will become a part of Arc’s Agriconnect business, which produces the Farmers Guardian magazine and organises events including LAMMA, Croptec, Future Farming Expo, and Farm Business Innovation. This acquisition adds depth to Arc’s presence in the key sustainability sector in agriculture.

LCA is comprised of four co-located events, Energy Now Expo, Environmental Business Expo, Farm Technology Expo, and Low Emissions Vehicle Expo. These content-led exhibitions will become a part of Arc’s Agriconnect business, which produces the Farmers Guardian magazine and organises events including LAMMA, Croptec, Future Farming Expo, and Farm Business Innovation. This acquisition adds depth to Arc’s presence in the key sustainability sector in agriculture.

LCA founder, David Jacobmeyer, will work in partnership with Agriconnect to continue developing the event within the farming community as well as providing thought-leadership about renewables, low carbon solutions and environmental best practices.

“We’ve seen tremendous growth and interest in both clean energy and low carbon sectors since we launched our first event in 2010,” commented David Jacobmeyer. “The farming community has a critical role to play in reaching Net Zero, and there is an ever-growing need for farmers and landowners to come together to find ways to boost production sustainably. I am looking forward to both the growth of Low Carbon Agriculture and working closely with Agriconnect to help guide farmers through this huge period of change.”

Nick Ornstien, Managing Director of Agriconnect, added “Agriconnect prides itself on being not just ‘for’ the farming community but ‘of’ the community. Within our own teams, as well as throughout our diverse customer community, we’ve seen increasing interest for information about sustainable practices and plans in farming. That’s why I am so delighted to have LCA become a part of Agriconnect, and I am truly looking forward to partnering with David to continue our focus on this important sector in farming.”

Canson Capital Partners, an Arc founding partner, served as financial adviser on the deal.

###

About Arc

Arc is a B2B events, data, and media platform, backed by investment funds managed by EagleTree Capital. Founded to redefine business networking, Arc organises over 150 events a year and operates critical content platforms in HR technology, agriculture and food, financial services and investing and education technology. Arc has over 350 talented colleagues located in the U.S., U.K., Netherlands, and Singapore who focus on seeking out new ways to connect communities, wherever, whenever, or however people need to come together to grow their businesses. For more information, visit www.arc-network.com or find Arc on LinkedIn.

About LCA

Low Carbon Agriculture is designed to help farmers and landowners achieve a profitable and sustainable future through the generation of renewable energy and the implementation of low carbon technologies and best practices. The next event will take place on 6 – 7 March 2024 at the NAEC, Stoneleigh, and has four defined areas to explore: ‘Energy Now Expo’, ‘Environmental Business Expo’, ‘Low-Emission Vehicles Expo’ and ‘Farm Technology Expo.’ For more information visit www.lowcarbonagricultureshow.co.uk.

About EagleTree

EagleTree Capital is a leading New York-based middle-market private equity firm that has completed over 40 private equity investments and over 90 add-on transactions over the past 20+ years. EagleTree primarily invests in North America in the following sectors: media and business services, consumer, and water and specialty industrial. For more information, visit www.eagletree.com or find EagleTree on LinkedIn.

Contact

For more information, contact Caitlin Read [email protected].

Arc expands offerings in financial services sector with acquisition of Marketing in Partnership Ltd

LONDON, 30 May 2023 - Arc, the global events, data, and media platform backed by investment funds managed by EagleTree Capital, announces that it has acquired Marketing in Partnership Ltd (MiP) an events and marketing solutions partner for the asset management industry.

MiP organises the Joint Investment Conference (JIC), Select, and Global Investment Management Summit (GIMS) events, provides marketing solutions, and organises contracted events on behalf of its clients. The acquisition of MiP reinforces Arc’s commitment to the financial services community, as it is complementary to brands in the network, including Professional Adviser, Investment Week, and Global AgInvesting. In addition, the marketing solutions provided by MiP will help strengthen Arc’s full-service marketing agency capability for the UK financial sector, broadening the services offered by Incisive Works, the content and performance marketing agency of Incisive Media.

Helen Wagstaff, co-founder of MiP, said “Arc offers a great springboard for our future growth. The network provides us more opportunities to expand our business, whilst retaining our position as the trusted events and marketing solutions partner for the asset management sector.”

Simon Lodge, co-founder of MiP, added “Increasingly we are working across different territories as clients seek more simplicity and co-ordination of their event and marketing activities. Becoming part of Arc represents a powerful opportunity for MiP to help our clients globally and expand our overall offering.”

Jonathon Whiteley, Arc’s CEO for Europe, said “We are pleased to welcome Helen, Simon, and their team to Arc. MiP is a business I have long admired, and we are particularly looking forward to collaborating and sharing best practices amongst MiP and our leading financial services brands for the benefit of our clients and audiences.”

Simon Foster, Group CEO of Arc, said “This acquisition, together with new products like Investment IQ, underlines our commitment to leadership in serving the financial services community. We look forward to welcoming the MiP team to the network and working with them as we continue our commitment to continually developing our offerings for the sector.”

The deal, which was signed on 19 May, is the seventh acquisition for the Arc network, its fifth in Europe, and third in the financial services sector. Canson Capital Partners, an Arc founding partner, served as financial adviser on the deal.

###

Arc

Arc is a B2B events, data, and media platform, backed by investment funds managed by EagleTree Capital. Founded to redefine business networking, Arc organises over 150 events a year and operates critical content platforms in HR technology, agriculture and food, financial services and investing and education technology. Arc has over 300 talented colleagues located in the U.S., U.K., Netherlands, and Singapore who focus on seeking out new ways to connect communities, wherever, whenever, or however people need to come together to grow their businesses. For more information, visit www.arc-network.com or find Arc on LinkedIn.

About MiP

For over 20 years MiP has helped financial services firms communicate with their clients through live conferences, digital events and marketing solutions. MiP’s team of 22 event managers, content specialists, speaker experts and designers work in partnership with clients of all shapes and sizes to generate great results. For more information, visit www.mipagency.com.

EagleTree

EagleTree Capital is a leading New York-based middle-market private equity firm that has completed over 40 private equity investments and over 90 add-on transactions over the past 20+ years. EagleTree primarily invests in North America in the following sectors: media and business services, consumer, and water and specialty industrial. For more information, visit www.eagletree.com or find EagleTree on LinkedIn.

For more information

Contact Caitlin Read [email protected]

Arc accelerates U.S. development; signs agreement to acquire HR Tech and Ed Tech portfolios

LONDON, 13 October 2022 - Arc, the global events, data, and media platform backed by investment funds managed by EagleTree Capital, announced today it has entered into an agreement to acquire a portfolio of event and related media assets serving the HR Technology (“HR Tech”) and Education Technology (“Ed Tech”) sectors from LRP Media Group. Terms of the acquisition were not disclosed.

The acquisition will be the sixth and largest acquisition for Arc in the fourteen months since inception and will add substantial scale to the overall Arc platform. The assets will also significantly expand the Arc network in the U.S. creating a robust complement to Arc’s European business.

Simon Foster, Group CEO of Arc, said “This is a major development for Arc. The acquisition will expand our capabilities and operations in the U.S., and bring an experienced team, strong brands, and more high-growth verticals into the network. The HR Tech and Ed Tech teams have an impressive track record of launching and developing their brands, and we’re looking forward to working with our new colleagues to grow these portfolios and to further develop Arc in the United States.”

Ken Kahn, President & Founder of LRP Media Group, added, “The HR Tech and Ed Tech portfolios include nine best-in-class brands that the teams have done a fantastic job transforming and expanding over many years. We are incredibly proud of the teams and brands and believe that we have found a great home for them with Simon and the Arc team. We look forward to watching them succeed in this new era.”

These portfolios reflect Arc’s strategy to connect business communities wherever, whenever, and however they need. They provide a diverse range of engagement solutions for facilitating networking and business growth. The professionals are brought together through content platforms and networking events, like HR Technology Conference and Expo, Future of Education Technology Conference, HR Executive, District Administration and University Business.

This acquisition is expected to close at the end of October. Canson Capital Partners, an Arc founding partner, served as financial adviser to Arc. Jones Day and Plural Strategy Group served as Arc’s legal adviser and strategy advisor, respectively. JEGI CLARITY (www.jegiclarity.com), a pre-eminent M&A advisory firm for the media, marketing, information and technology industries, represented LRP Media Group in this transaction.

About

Arc

Arc is a B2B events, data, and media platform, backed by investment funds managed by EagleTree Capital. Founded to redefine business networking, Arc organises over 120 events a year and operates critical content platforms in HR technology, agriculture and food, financial services and investing and education technology. Arc is over 300 talented colleagues located in the U.S., U.K., Netherlands and Singapore that focus on seeking out new ways to connect communities, wherever, whenever, or however people need to come together to grow their businesses. For more information, visit www.arc-network.com or find Arc on LinkedIn.

EagleTree Capital

EagleTree Capital is a leading New York-based middle-market private equity firm that has completed over 40 private equity investments and over 80 add-on transactions over the past 20+ years. EagleTree primarily invests in North America in the following sectors: media and business services, consumer, and water and specialty industrial. For more information, visit www.eagletree.com or find EagleTree on LinkedIn.

Canson Capital Partners

Canson Capital Partners is a leading Alternative Capital focused Advisory and Merchant Banking firm. Providing senior advice and principal to principal engagement, we seek to connect sources of Alternative Capital with specific opportunities enabling our clients to achieve their long-term strategic objectives. Since inception, Canson has advised on transactions with an aggregate enterprise value of c.$70 billion, with a strong track record of partnership focused transactions, and have c. $500m AUM invested alongside our clients. Notably, Canson advised Providence on its £600m sale of Clarion Events to Blackstone. Canson Capital Partners is the trading name of Canson Ltd, which is authorised and regulated by the Financial Conduct Authority. For more information, please visit www.cansoncp.com.

LRP Media Group

LRP Media Group, founded in 1977, is an innovative media giant serving millions of business and education professionals worldwide. Specializing in education administration, education law, education technology, federal employment, and human resources. For more information, visit www.lrp.com/about or find LRP Media Group on LinkedIn.

Contact

Caitlin Read [email protected]

Arc acquires its first US-based business HighQuest Group

LONDON, 24 August 2022 - Arc, the global events, data, and media platform backed by investment funds managed by EagleTree Capital, announced today it has completed its first acquisition of a US-based business. The transaction includes the events and media assets of HighQuest, Global AgInvesting (GAI), Women in Agribusiness (WIA), Unconventional Ag (UA), and the Ag Club.

Headquartered near Boston, HighQuest produces media and events for the agribusiness sector around the globe. Its annual summits take place in the US, UK, and Japan. The Global AgInvesting summits are the world’s largest gatherings of agriculture investors and sector stakeholders, and the Women in Agribusiness summits provide a network platform at the forefront of women’s excellence in agribusiness. In addition to the flagship GAI NY and WIA, the team also produces a suite of other live events, host webinars, run GAI News, and produce research for the sector.

HighQuest CEO, Greg Mellinger, said, “During the financial crisis in 2009, we launched our first conference in response to the ballooning interest in farmland investment. Since then, we’ve been on a tremendous growth journey as an organization becoming the world leader in connecting the agriculture investment communities, creating a platform for promoting women’s excellence in agribusiness, and continuously finding new ways to connect industry stakeholders. With an increasing global focus on food security the need to connect on sustainable strategies to propel forward the future of global agriculture has never been more pressing. We have big ambitions to assist our clients’ growth and success in this sector, and so we are extremely pleased to be partnering with Arc to further develop the business.”

Arc Group CEO, Simon Foster, said, “I’m delighted to welcome Greg and the team to Arc. This is a great business, in a high-growth sector, that also happens to be a perfect fit for our network. These brands sit at the intersection of our established sector communities - finance, agriculture, food, and sustainability - and have a particularly strong fit with brands like Professional Pensions, Sustainable Investment, and Bridge2Food. We look forward to working closely with Greg and the team, to sharing best practices throughout the network and helping to grow GAI, WIA, UA and the Ag Club.”

This is Arc’s first investment in North America and fifth acquisition in the last twelve months. Arc continues its development as the next generation events and media platform supporting B2B communities around the world.

Canson Capital Partners, a participant in the Arc partnership since its inception, served as financial adviser to Arc.

For more information on the brands

Arc

Arc is a B2B events, data, and media platform, backed by investment funds managed by EagleTree Capital. Founded to redefine business networking, Arc organises over 100 events a year and runs some of the foremost content platforms in agriculture, food, business sustainability, and financial services. Arc has 220 talented colleagues located in the UK, Netherlands, and US that focus on seeking out new ways to connect communities, wherever, whenever, or however, people need to come together to grow their business.

EagleTree Capital

EagleTree Capital is a leading New York-based middle-market private equity firm that has completed over 40 private equity investments and over 80 add-on transactions over the past 20+ years. EagleTree primarily invests in North America in the following sectors: media and business services, consumer, and water and specialty industrial. For more information, visit www.eagletree.com or find EagleTree on LinkedIn.

Canson Capital Partners

Canson Capital Partners is a leading Alternative Capital focused Advisory and Merchant Banking firm. Providing senior advice and principal to principal engagement, we seek to connect sources of Alternative Capital with specific opportunities enabling our clients to achieve their long-term strategic objectives. Since inception, Canson has advised on transactions with an aggregate enterprise value of c.$70 billion, with a strong track record of partnership focused transactions, and have c. $500m AUM invested alongside our clients. Notably, Canson advised Providence on its £600m sale of Clarion Events to Blackstone. Canson Capital Partners is the trading name of Canson Ltd, which is authorised and regulated by the Financial Conduct Authority. For more information, please visit www.cansoncp.com

Arc partners with Bridge2Food

LONDON, 16 May 2022 - Arc, the global events, data, and media platform backed by investment funds managed by EagleTree Capital, announced today it has entered into an investment partnership with Bridge2Food, a membership and events business in the plant-based food and proteins industry.

Headquartered in the Netherlands, Bridge2Food operates the largest global collaboration platform for innovation leaders in the food and beverage industry, the Global Industry Plant-Based Foods & Proteins Ecosystem. Through its Ecosystem, as well as annual summits and academy courses, Bridge2Food has created a network of over 10,000 business and technical experts in the food industry.

Bridge2Food Founder, Gerard Klein Essink, said “For over 20 years, Bridge2Food has brought together a global network of professionals striving to advance actions for a better food world. We’ve been the go-to platform for research and innovations in the plant-based food community, and we are excited to advance and accelerate our development as part of the Arc network. Together, we will be able to open even more doors for the research and industry professionals in our Ecosystem.”

Arc Group CEO, Simon Foster, said, “I’m delighted to welcome Bridge2Food to the Arc network. Gerard and his team have long-championed the community-focused membership model for uniting industry and driving change. We are enthusiastically supportive of this vision and look forward to working with him and the team to continue this spirit of innovation and transformation both in this sector as well as throughout the wider Arc network.”

Bridge2Food joins Arc’s robust portfolio of content and event assets in the agriculture sector, reinforcing Arc’s commitment to the vital, globally-connected, industry. Arc’s existing agricultural portfolio, Agriconnect, includes flagship brands Farmer’s Guardian and LAMMA, as well as Farm Business Innovation, the leading series of rural diversification events.

This is Arc’s first investment in Europe, and fourth deal in the past eight months, following on from last month’s acquisition of Incisive Media. Arc is continuing its development as the next generation events and media platform supporting B2B communities around the world.

Canson Capital Partners, a participant in the Arc partnership since its inception, served as financial adviser to Arc. Collingwood Advisory advised Bridge2Food on the transaction.

About

Bridge2Food

Bridge2Food is a global leader in the plant-based foods and alternative proteins sector. Since 2002, it has been working to connect professionals, researchers and industry, to organize summits that grow ideas into actions, to educate in hands-on academy courses, and to develop ecosystems that foster innovation.

Arc

Arc is a B2B events and media platform, backed by investment funds managed by EagleTree Capital. Founded to redefine business networking, Arc organises over 100 events a year and runs some of the foremost content platforms in agriculture, business sustainability, and financial services. Based in the UK and the Netherlands, Arc [operates three businesses and] has 200 talented colleagues focused on seeking out new ways to connect communities, wherever, whenever, or however, people need to come together to grow their business.

EagleTree Capital

EagleTree Capital is a leading New York-based middle-market private equity firm that has completed over 35 private equity investments and over 75 add-on transactions over the past 20+ years. EagleTree primarily invests in North America in the following sectors: media and business services, consumer, and water and specialty industrial. For more information, visit www.eagletree.com or find EagleTree on LinkedIn.

Canson Capital Partners

Canson Capital Partners is a leading Alternative Capital focused Advisory and Merchant Banking firm. Providing senior advice and principal to principal engagement, we seek to connect sources of Alternative Capital with specific opportunities enabling our clients to achieve their long-term strategic objectives. Canson has advised on over $60 billion of transactions since inception, with a strong track record of partnership focused transactions, and have c. $500m AUM invested alongside our clients. Notably, Canson advised Providence on its £600m sale of Clarion Events to Blackstone. Canson Capital Partners is the trading name of Canson Ltd, which is authorised and regulated by the Financial Conduct Authority. For more information, please visit www.cansoncp.com

Contact

Caitlin Read

[email protected]

+44 (0) 7727 860756

EagleTree backed companies, Arc and The Channel Company, acquire Incisive Media

London, 6 April 2022 - Arc, the global events, data, and media platform, announced today it has acquired Incisive Media’s financial services and business sustainability portfolios. These portfolios expand Arc’s sector diversity across the UK market with the addition of leading financial services and business sustainability brands such as Investment Week, Professional Pensions, Professional Adviser, and BusinessGreen.

The Channel Company, a leading IT-channel focused B2B marketing company, will acquire Incisive’s technology portfolio. The acquisition will reunite CRN and CRN UK under the same company. The technology portfolio also includes the Computing and Channel Partner Insight brands.

Simon Foster, CEO of Arc, said, “This is a pivotal step in the evolution of Arc. We are pleased to welcome Incisive Media CEO, Jonathon Whiteley, and the financial services and business sustainability teams to Arc, and look forward to growing and developing these portfolios. We also look forward to further developing the Arc platform through this acquisition with the addition of more resources and channels with which we can grow our network.”

Blaine Raddon, CEO of The Channel Company, said, “We are excited to add Incisive’s technology channel brands to our portfolio, and believe the reunification of the US and UK CRN brands will provide substantial benefit to our audiences and clients. This acquisition gives us the opportunity to link Incisive’s Computing brand with our Midsize Enterprise Services brand in a powerful, connected, global end-user community. Altogether, the acquisition results in a leading position for The Channel Company in content and events in both the US and EMEA.”

Jonathon Whiteley, CEO of Incisive Media, said, “Following a very successful period of growth over the last few years, Incisive Media is now ready for its next stage of development. The global platforms of Arc and The Channel Company offer natural homes for Incisive Media’s brands and people. Our audience and customer centric approach to growing and supporting the end markets that we serve fits squarely with the philosophies of both Arc and The Channel Company. This split allows us to support that growth in a relevant and focused way. I am excited about the future and look forward to working with Simon and his team at Arc to take Incisive Media into this next and exciting chapter.”

Cardean Bell advised Incisive on the transaction and Macfarlanes provided legal advice. Arc’s M&A advisor was Canson Capital Partners. Jones Day was legal advisor to both Arc and The Channel Company. Plural Strategy Group advised Arc and The Channel Company on commercial due diligence.

Incisive Media

Based in the heart of London, Incisive Media is an award-winning business to business digital media and events business established in 1995. Operating in the financial services, enterprise technology and business sustainability markets we have some of the most influential, engaging and well-known brands in business media.

We are a tech-enabled, forward facing marketing services business that connects and informs business professionals through our analyst-grade content and our market leading events. We offer our clients the ability to reach their customers through advanced and integrated digital marketing activations and we are constantly adapting to the ever-changing digital marketplace. www.incisivemedia.com

Arc

Arc is a B2B platform backed by investment funds managed by EagleTree Capital that intends to redefine business networks by building the next generation events and media business. With a customer-centric approach, guided by data and intelligent insight, Arc seeks out ways to connect communities, wherever, whenever, or however, people need to come together to meet, network, learn, and grow their businesses.

The Channel Company

The Channel Company is focused on the technology industry and its CRN brand is celebrating its 40th anniversary in 2022. Headquartered in Westborough, MA, The Channel Company has been servicing the technology channel community for over 40 years. From CRN, the #1 source of technology news, insights and analysis for the IT Channel, to industry-leading events that connect clients to customers, to powerful research, consulting and engaging education to accelerate growth, to transformative marketing services to maximize investment, The Channel Company provides a full suite of outcome-driven services focused on addressing the channel’s unique needs worldwide.

The Channel Company is a portfolio company of investment funds managed by EagleTree Capital, a New York City-based private equity firm. www.thechannelcompany.com

EagleTree Capital

EagleTree Capital is a leading New York-based middle-market private equity firm that has completed over 35 private equity investments and over 75 add-on transactions over the past 20+ years. EagleTree primarily invests in North America in the following sectors: media and business services, consumer, and water and specialty industrial. For more information, visit www.eagletree.com or find EagleTree on LinkedIn.

Canson Capital Partners

Canson Capital Partners is a leading Alternative Capital focused Advisory and Merchant Banking firm. Providing senior advice and principal to principal engagement, we seek to connect sources of Alternative Capital with specific opportunities enabling our clients to achieve their long-term strategic objectives. Canson has advised on over $60 billion of transactions since inception, with a strong track record of partnership focused transactions, and have c. $500m AUM invested alongside our clients. Notably, Canson advised Providence on its £600m sale of Clarion Events to Blackstone. Canson Capital Partners is the trading name of Canson Ltd, which is authorised and regulated by the Financial Conduct Authority. For more information, please visit www.cansoncp.com.

Contact

Incisive Media - Sophie Eke - [email protected]

Arc - Caitlin Read - [email protected]

The Channel Company - Jade Surrette - [email protected]

Arc acquires rural and leisure portfolio from Fortem International

LONDON, November 29th, 2021 – Arc, the global events, data, and media platform backed by investment funds managed by EagleTree Capital, announced today it has acquired five rural sector events from Fortem International. These events will become part of Arc’s Agriconnect business (Farmers Guardian Ltd. and LAMMA Ltd.), adding additional depth and reach across the expansive UK agriculture sector.

The five co-located events in the portfolio connect UK farmers and land owners who are seeking alternative sources of income.

Sanjeev Khaira, who leads Agriconnect, said, “We are excited to add the rural and leisure portfolio to Agriconnect, which is already one of the UK’s largest agricultural information and events platforms. The addition of this portfolio, which includes leading events Farm Business Innovation and Holiday Park and Resort Innovation, gives us more opportunities to empower and inspire people and businesses in agriculture. We view this transaction as the beginning of a long term partnership.” The existing team at Fortem International will continue to run the portfolio through the next edition, November 2nd and 3rd 2022.

Tom Borthen, CEO of Fortem International said, “We are pleased to be entering into a partnership with the Arc team, and are excited for the growth potential of the rural and leisure portfolio as it becomes part of Agriconnect and Arc. We see this as a tremendous opportunity to learn from each other and leverage our collective content and events experience in order to develop more opportunities for our customers to come together and make the connections they need.”

This is Arc’s second acquisition as it continues to develop its position as a next generation events and media platform for B2B communities around the world. Canson Capital Partners (“Canson”), a participant in the partnership since its inception, served as financial adviser to Arc.

Arc acquires Farmers Guardian and LAMMA trade show from AgriBriefing

Arc Acquires Farmers Guardian and LAMMA Trade Show from AgriBriefing

First Acquisition for the Arc Platform

LONDON, August 19th, 2021 – Arc, the global events, data, and media platform backed by investment funds managed by EagleTree Capital, today announced it has acquired Farmers Guardian Ltd and LAMMA Ltd, the UK agriculture division of AgriBriefing. The businesses are leaders in the agriculture sector, delivering content and connections to over 130,000 members of the British farming community.

Robert Gray, EagleTree Capital Operating Partner, said “We are very pleased with this first acquisition for Arc. These are strong multiplatform brands and a highly appealing sector to have as the starting point for building the next generation events and media platform for B2B communities around the world.”

Sanjeev Khaira will lead the Arc team for this acquisition and work in partnership with existing Managing Director, Warren Butcher, and the management team to support and continue the strategic growth plans of each business. Together, they intend to accelerate the growth and prominence of the LAMMA and CropTec events, and expand the reach and influence of Farmers Guardian, Dairy Farmer and Arable Farming print and online brands.

After a decade of guiding and building these businesses, AgriBriefing has evolved its strategy to focus more on its global pricing, analytics, forecasting, market data and consulting units.

Rory Brown, CEO of AgriBriefing, said, “We are enormously proud of the job the teams of Farmers Guardian and LAMMA have done, but our strategic focus has changed. We could not have found a better home for our brands, and the teams who work on them. We cheer their future success from the sidelines as these businesses enter their next phase.”

Simon Foster, Arc CEO, said, “We are excited about this first step in the development of Arc. These two businesses are a strong foundation from which to start, and we look forward to building out the Arc network with similar businesses to create a platform to facilitate the future of networking, connecting, and supporting business communities.”

Canson Capital Partners (“Canson”), a participant in the partnership since its inception, served as financial adviser to Arc.

More information

Contact

Caitlin Read, [email protected], +44 (0) 7727 860756

Arc is a B2B platform backed by investment funds managed by EagleTree Capital that intends to redefine business networks by building the next generation events and media business. With a customer-centric approach, guided by data and intelligent insight, Arc seeks out ways to connect communities, wherever, whenever, or however, people need to come together to meet, network, learn, and grow their businesses.

About Farmers Guardian and LAMMA

The agriculture portfolio includes; Farmers Guardian, at the heart of UK agriculture since 1844 serving the community with editorial content and digital services, LAMMA, the UK’s leading farm machinery, equipment and services exhibition, CropTec, the leading UK knowledge exchange for progressive arable farmers and agronomists, and the British Farming Awards, the premier recognition event for the UK agriculture industry. In addition, the portfolio also has specialist information and media brands and services, such as Arable Farming and Dairy Farmer, as well as an integrated marketing agency, Insightful.

About EagleTree Capital

EagleTree Capital is a leading New York-based middle-market private equity firm that has invested approximately $2.8 billion of equity capital since inception. The Firm has completed over 35 private equity investments and over 70 add-on transactions over the past 20+ years. EagleTree primarily invests in the following sectors: media and business services, consumer, and water and specialty industrial.

About Canson Capital Partners

Canson Capital Partners (Canson) is a leading Alternative Capital focused Advisory and Merchant Banking firm. Providing senior advice and principal to principal engagement, we seek to connect sources of Alternative Capital with specific opportunities enabling our clients to achieve their long-term strategic objectives. Canson has advised on over $54 billion of transactions since inception, with a strong track record of partnership focused transactions, and have c. $500m AUM invested alongside our clients. Notably, Canson advised Providence on its £600m sale of Clarion Events to Blackstone. Canson Capital Partners is the trading name of Canson Ltd, which is authorised and regulated by the Financial Conduct Authority.

About AgriBriefing

AgriBriefing (www.agribriefing.com) employs more than 200 people across London; Preston, UK; Paris, France; Toulouse, France; and Tom’s River, New Jersey, USA.

The management team includes CEO Rory Brown, CFO Rupert Levy and Non-Executive Chairman Gehan Talwatte.